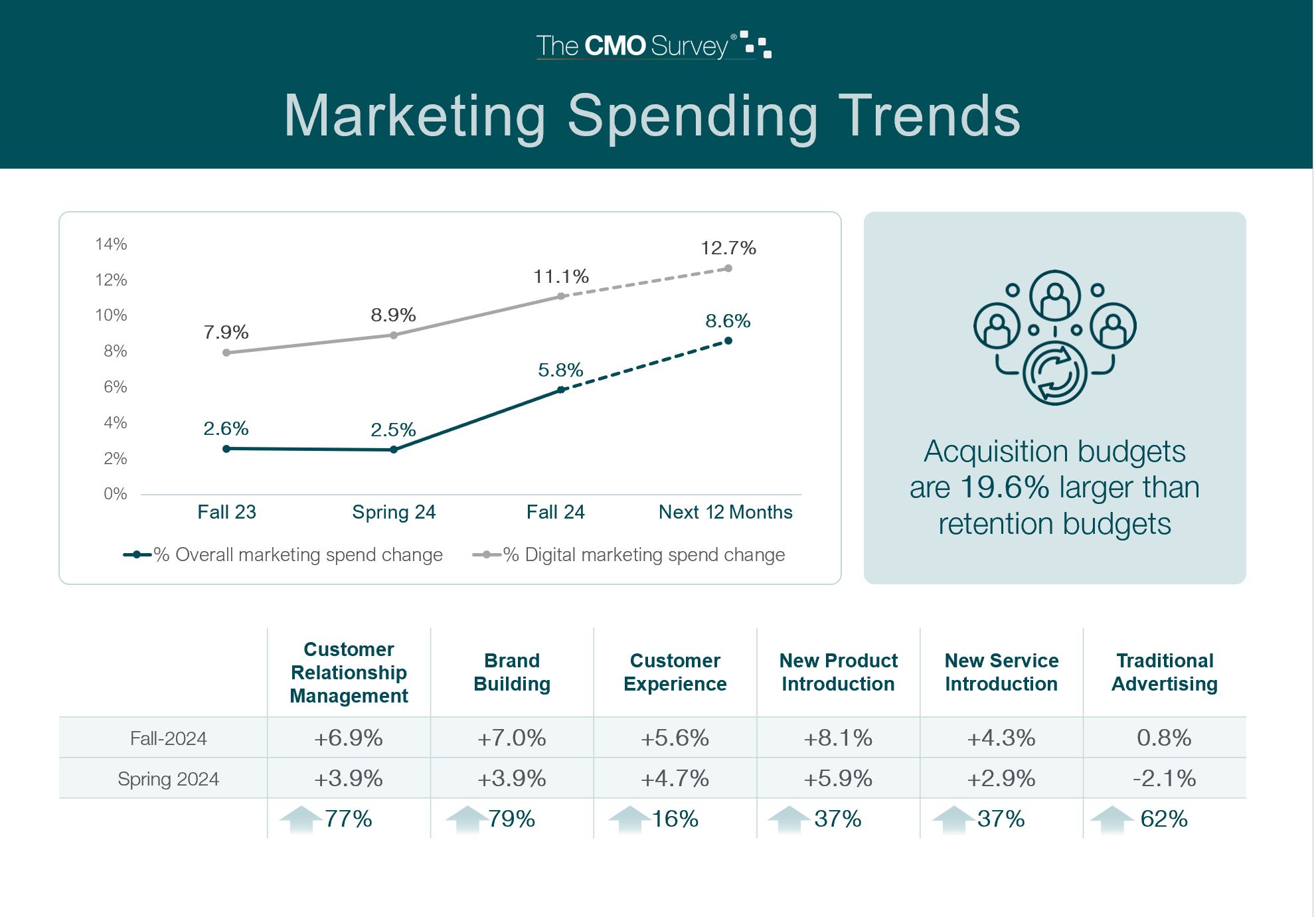

Marketing leaders’ optimism about the U.S. economy lost strength, as a three-year-high in confidence levels recorded last spring was dampened by election uncertainty and lingering inflation worries. But despite macroeconomic and political concerns, marketing spending at U.S companies grew by 5.8% during the last year, up from a growth rate of 2.5% in the last survey with projected growth of 8.6% over the next 12 months.

This is according to the 33rd edition of The CMO Survey, directed by Professor Christine Moorman of Duke University’s Fuqua School of Business and co-sponsored by Fuqua, Deloitte, and the American Marketing Association. This edition, which was conducted September 4-25, sampled 260 marketing leaders at for-profit U.S. companies, 97% of whom hold positions at VP-level or higher.

The survey found that overall marketing spending is bouncing back toward the four-year-high levels notched in Fall 2022, after weaker growth rates for the past years. Despite this, marketing spending as a percentage of companies’ budgets and revenues is lower, indicating that both revenues and overall budgets are growing faster than marketing budgets.

Digital marketing spending continues its upward trajectory, rising from 8.9% to 11.1% growth. Marketers predict they will increase digital marketing spending further—by 12.7% over the next 12 months. Drilling down, marketers expect to spend more on customer relationship management (+ 6.9%), customer experience (+ 5.6%), branding (+ 7.0%), new product introductions (+ 8.1%), and new service introductions (+ 4.3%) in the next year. Traditional advertising spending growth is also positive, at 0.8%, for the first time in two years and only the fourth time in a decade.

Digital marketing spending continues its upward trajectory, rising from 8.9% to 11.1% growth. Marketers predict they will increase digital marketing spending further—by 12.7% over the next 12 months. Drilling down, marketers expect to spend more on customer relationship management (+ 6.9%), customer experience (+ 5.6%), branding (+ 7.0%), new product introductions (+ 8.1%), and new service introductions (+ 4.3%) in the next year. Traditional advertising spending growth is also positive, at 0.8%, for the first time in two years and only the fourth time in a decade.

Marketers report that, in general, they are spending 19.6% more on acquiring customers than retaining them. They also indicate that although their ideal branding budget would be 50% long-term brand building and 50% short-term brand performance, the actual ratio is 31.2% (long-term) and 68.8% (short-term).

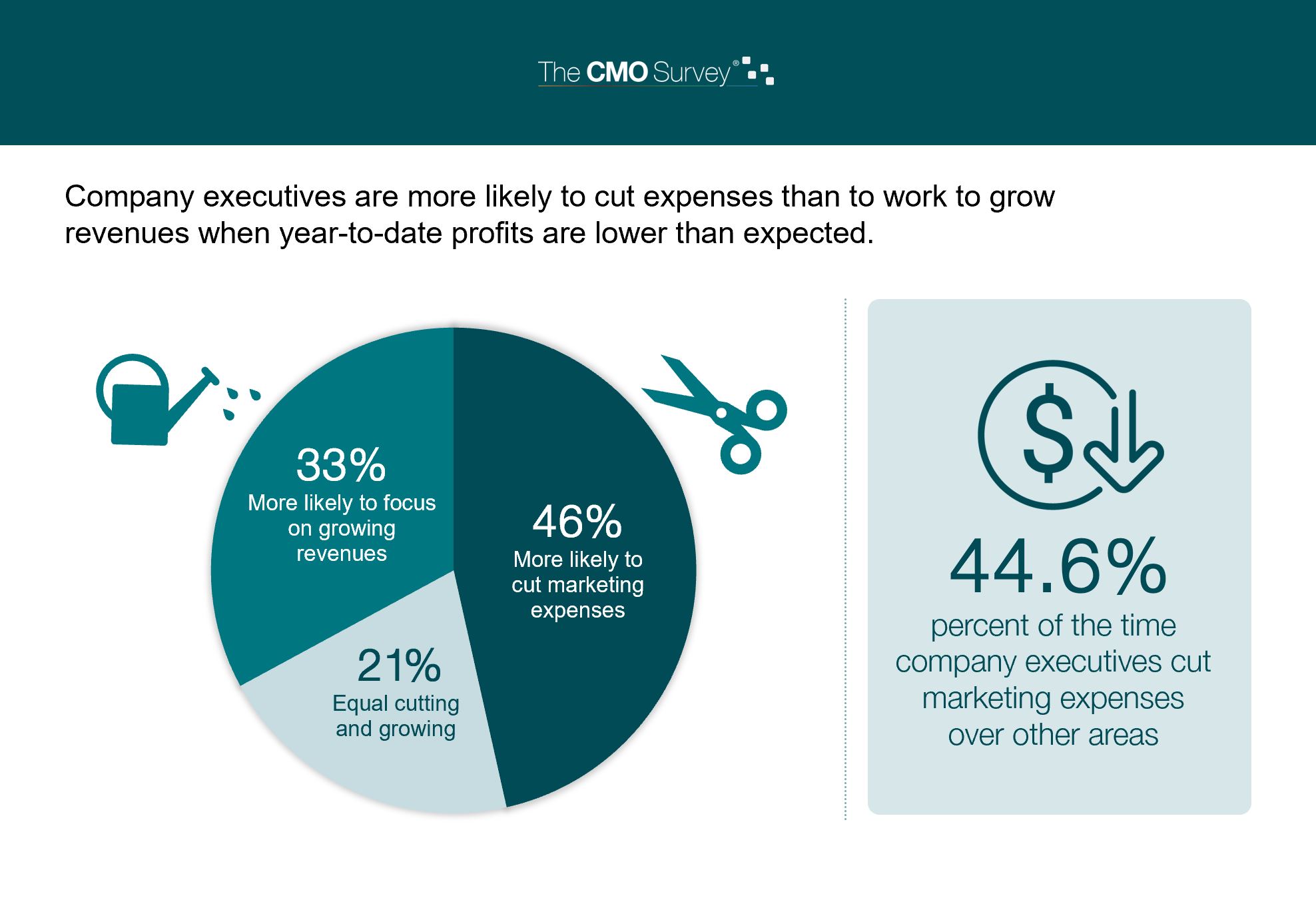

Marketers report that when profits do not meet targets, executives are generally more likely to cut expenses than to try to grow revenues—46% are more likely to focus on cutting expenses compared to 33% more likely to grow revenues with the remaining 21% having an equal focus on cutting and growing. And among the first expenses to be cut, marketing is disproportionately impacted: 44.6% of the time, executives would cut marketing expenses over other areas.

Other research shows that while this “marketing myopia” may seem to solve the earnings deficit, it causes long-run problems and investors realize the negative effects of these marketing cuts and adjust their valuations accordingly.

Marketing organizations grew headcount by 5.3% in Fall 2024, rebounding from an earlier dip of 3.9% growth in Spring 2024. B2B Services companies grew the most (7.6%), followed by B2C Product companies (5.3%). Across industries, Education (25.3%), Banking / Finance / Insurance (14.8%), and Healthcare organizations (9.8%) achieved the most growth, while Mining / Construction (-20%), Retail / Wholesale (-5.8%), and Communications / Media (-4.9%) all shrank.

Three reports summarize these and other results related to AI, martech, and privacy.

- The Highlights and Insights Report

Key metrics, trends, and insights over time - The Topline Report

Aggregate view of results - The Firm & Industry Breakout Report

Results by sector, size, and online sales